If you are a bitcoin maxi and read that title, you probably have a pitchfork in hand and are ready to burn me at the stake. However, if you’re a rational investor who cares about return on investment and maximizing your profits with solid fundamentals read on.

So how do we know that the Bitcoin top is almost here? I mean if you have been in the crypto space for at least a year, I’m sure you have heard calls for Bitcoin tops ranging anywhere from $250,000 to even $1,000,000 (Micheal Saylor I’m looking at you). But are those predictions true? How do we know where Bitcoin will peak? The truth is we don’t know for sure, but we can make an educated guess.

So where will Bitcoin peak? My professional opinion is somewhere between $130,000 to $140,000. A far cry from the quarter of a million you hear being parroted on every financial news channel. So how did I come to this conclusion? Its actually pretty easy and I’ll show you how I came to that conclusion. Here are is the evidence that lead me to believe that we are almost at the bitcoin top.

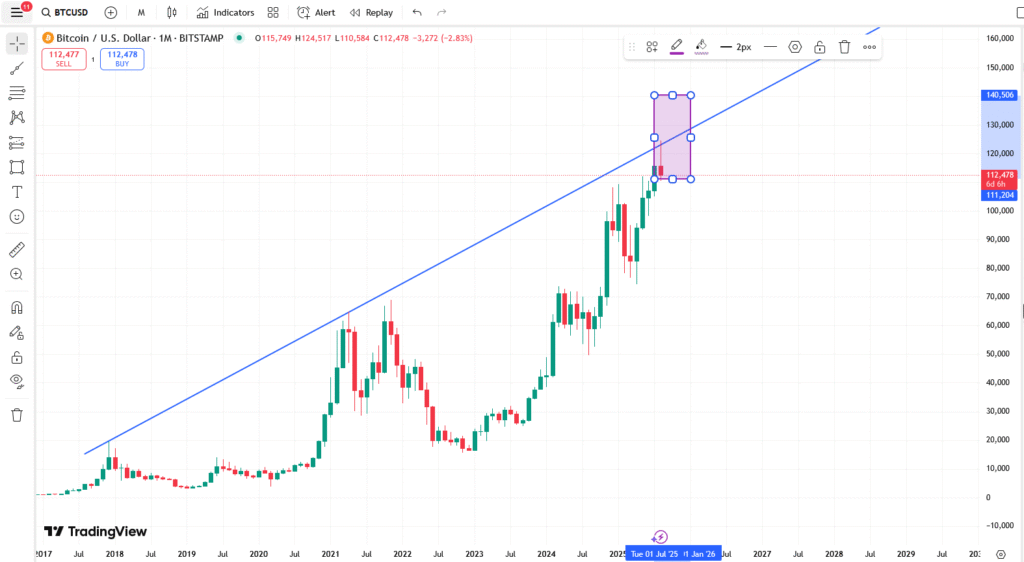

Basic Trend Lines

Take a look at this chart, notice the simple trendline that measures the top. Trend lines drawn from the two previous peaks offer tremendous resistance. Whales can see it, Wall Street can see it, and retail can see it. This simple line will create massive selling pressure right around 130,000. Sure the bulls will try to push it above 130 and I’m sure they will, but it will wick for the month of OCT or NOV and not break past 140 since that is a hard psychological level.

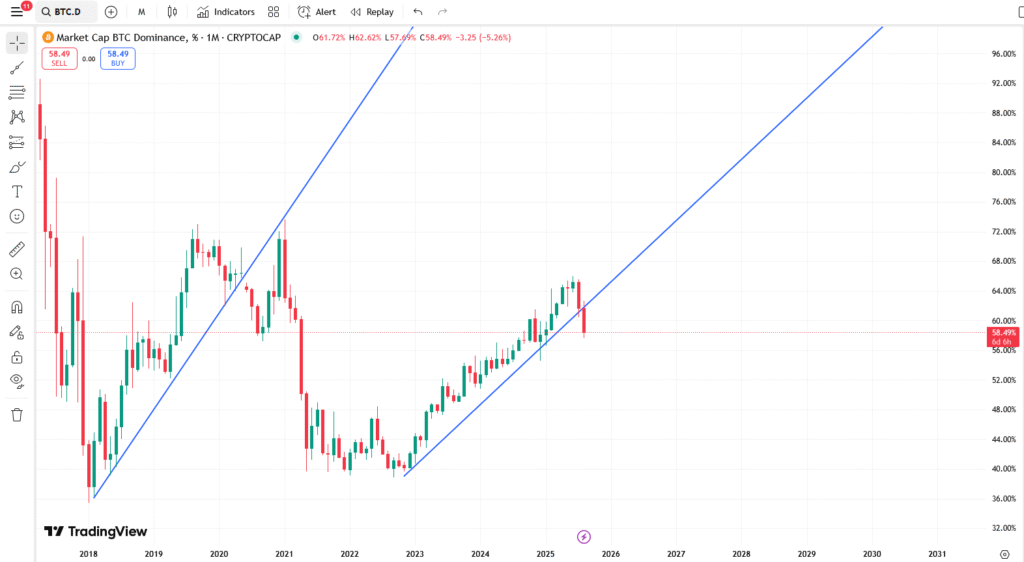

Bitcoin Dominance fading

Now for those of you who may not know but Bitcoin dominance just measures how much market share Bitcoin has compared to other cryptocurrencies. For example, if Bitcoin dominance is at 60%, that means 60% of all the crypto market value is just bitcoin. If you look at this chart you can see that the Bitcoin Dominance price action has broken its trend line.

The last time this happened, it retested the trend link break, peaked in price, then collapsed and ushered in alt season. When you combine it with the trend line, it’s already starting to paint the picture that the top will be in soon.

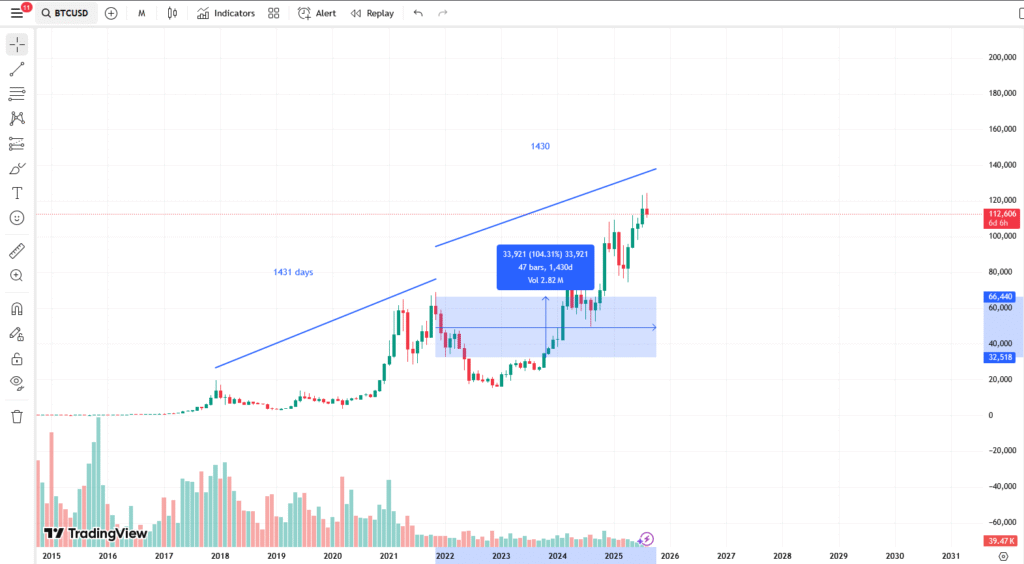

Peak to Peak Cycle Timing

Take a look at this chart. From the high in DEC 2017 to Nov 21 was approximately 1431 days. Now if we take that exact same number of 1430 days it gives us a time frame of OCT 2025, or about 60ish days left for the Bitcoin top to occur, which according to the Trend line would once again put it at around 130k ish. This is in line with the 4 year cycle theory of Bitcoin, that says Bitcoin rises and falls in 4 year cycles.

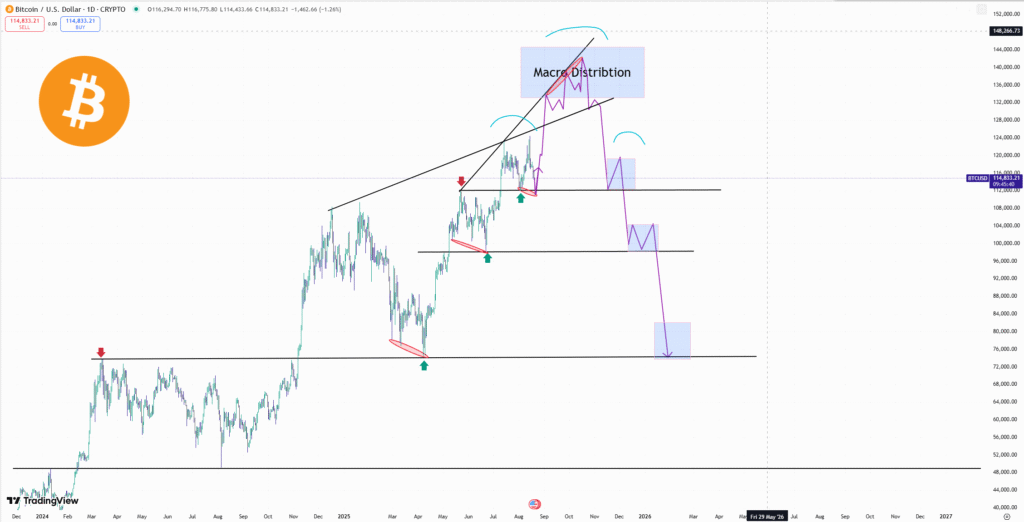

Fantastic TA

The Wyckoff Architect created some of the most beautiful Technical Analysis (TA) I have seen on Bitcoin recently. He said “I believe we’ll see one last leg up on $BTC , forming its topping structure in the $133K–$145K range before entering Macro distribution. Alts should be much stronger in this phase.”

If you notice he shows supply and resistance zones and draws out a head and shoulders pattern that is in line with Dominance, Peak Timing, and the Trend line.

Genisis Whales are dumping

What is a Whale, let alone a Genisis whale? A whale is someone who owns a tremendous amount of an asset. For example if someone owns 100,000 bitcoin they would be considered a whale today. A Genisis Whale is someone who bought Bitcoin when it was first created before its first pump in summer of 2011. Many of these “Genisis Whales” are opening up their crypto wallets for the first time and selling their bitcoin. These people had the foresight to buy extremely low, and now they are selling high. Smart money usually sells before or at the top and we have proof that at least several dozen Genisis Whale have sold. In fact one sold over 25,000 Bitcoin this past weekend and caused the entire crypto market to dump.

7x from previous cycle low

People make the major mistake of measuring peaks when trying to determine where the Bitcoin price is going to go. The previous cycle saw Bitcoin go from 19,000 all the way to 64,000 in 2021. So most retail traders assume that the market must also triple, and are expecting that price should hit $180,000 this cycle. But that is folly. Each Cycle top, gets smaller and smaller in terms of multipliers for a very simple reason. The higher the price of Bitcoin, the more expensive it is to move it.

So for example in 2013, Bitcoin peaked at $1,100 dollars, which was 37X move from the previous high of 29 dollars. Then in 2017 Bitcoin peaked at $19,190, which was roughly 17.5X move from the previous high. Then in 2021 Bitcoin peaked at $64,900 which was roughly, 3.4X move. Now look at that, the first move was 37x, then 17.5x, then 3.4x. Every time bitcoin peaks, the multiplier is but by at least half. But it we measure the peak to the latest all time high we are almost at 2x, which is more than the 1.7 expected. The chance of Bitcoin doing something its never done before which is reach a previous multiplier is extremely unlikely. The best case scenario would place Bitcoin at 217k. But as you can see when you look at all the other facts, its probably not going to happen.

Bitcoin already has had a 7.75x move from the previous cycle low of about 16,000, which is already pretty fantastic.

All the cool bitcoin news is over this cycle. ETFs.

Bitcoins ETF’s are already created and being sold. Government adoption news has already played out. There is nothing in the immediate horizon that can Bitcoin investors can look forward to. All the positive news this cycle has been used up. Sure there will be one or two more unexpected events to occur, but everything everyone was hoping for has occurred except for one thing.

The Federal Reserve cutting rates. Bitcoin has made all this progress in a high interest rate market despite the Feds policies. Cutting rates could be the final news catalyst to push Bitcoin to its top. Cheap money will do that. In fact Jerome Powell and the Fed have already signaled that rate cuts are coming this year. But that doesn’t take away from all the previous points of evidence I have shown you. In fact, even the biggest maxi’s are starting to “act” a little differently.

Micheal Saylor Cryptic Tweet

@Whalenoname and others have noted that Micheal Saylor has made cryptic tweets that preceded market dumps.

Well the last time Saylor said this the Bitcoin market had a 32k drop as you can see in the chart. Guess what he just said 2 weeks ago? The same thing.

Other coins are more attractive.

Most real investors are not dumb, despite what Wall Street says. Everyone who actually studies the markets can see that Bitcoins time is coming to an end this cycle. If you want to ‘double’ your investment in Bitcoin at this moment in time, you would have to hope it hits $250,000 this cycle. But what if you sold your Bitcoin and then bought an alt coin instead with a low market cap? You could 10x your gains even further. Well guess what. That’s exactly what happens every cycle for the last 2 cycles. People sell their bitcoin positions, lock in their profits and then buy altcoins and pump those bags even further. Most altcoins have not had a proper alt season yet, and with Bitcoin dominance fading and ROI shrinking, those alt coins are looking extremely attractive. You had better believe that Wall Street sees this too. And money flowing into Alt coins, means money NOT flowing into Bitcoin.

When you look at all the facts I have laid out I think it’s pretty clear that the chance of Bitcoin topping out soon, is pretty high. However, this information begs the question.

What should you do?

Honestly that’s your call. I won’t give you investment advice, but Ill share with you common strategies used by both pros and retail.

- HODL: Do nothing and ride the wave. The benefits is that you get don’t have to pay any capital gains and if you are in no rush, you don’t have to worry about timing the market either.

- Rotate: Riskier but can keep the party going. People will dump their money into alt coins and try to get those FOMO pumps, squeezing every bit of profit before the bull run ends.

- Investing in Boring but safe assets: Some might decide its time to pull a Peter Schiff and dump their money into gold and bonds. Yeah its boring, but its much safer in that it’s a hedge against inflation. And if the stock or Crypto market takes a dump your wealth probably wont get hurt either. However, you wont make much in profit.

So no matter what you decide to do, always make sure you do your research and know what your doing and why your doing it.

Best of luck everyone!

-Will